Sickness Allowance. You can no longer claim Sickness Allowance. But you may be able to claim another income support payment. If you're sick or injured and can't do your usual work or study, you can apply for JobSeeker Payment. We also have translated information about JobSeeker Payment.. You may be eligible for Sickness Allowance if you are unable to work due to a temporary illness or accident. You must be: 22 years or older, but under age pension age, and have a job or getting ABSTUDY as a full time student, or 25 years or older, but under age pension age, and getting Austudy as a full time student, and

How to apply for Sickness Benefit Reimbursement Applications (SBRAs) Online SSS Inquiries

Extending Sickness Benefits

SSSApproved How to submit a Sickness Benefit Reimbursement Application (for Employers

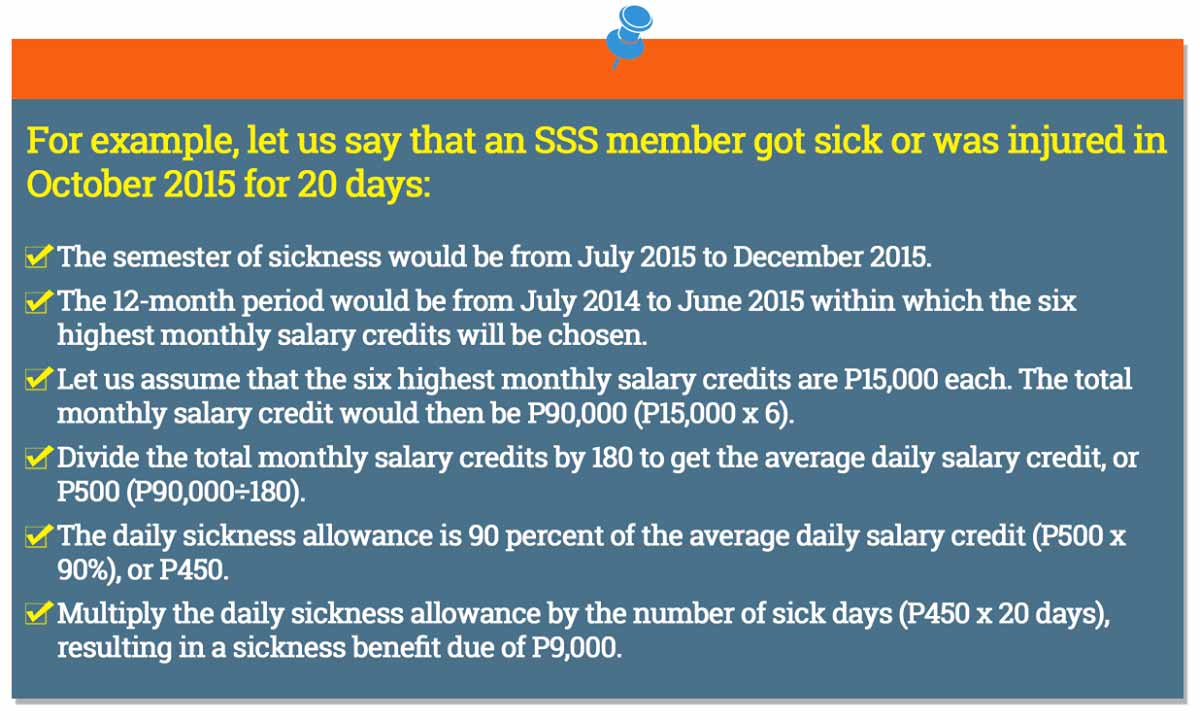

How To Compute Sss Sickness Benefit THOUGHTSKOTO There is a proper and official way on how

🔴 How Do I Claim Sickness Benefit 2024 Updated RECHARGUE YOUR LIFE

SSS sickness benefit in the Philippines 2023 TESDA COURSES

Employment Insurance Sickness Benefits Extension

SSS Sickness Benefit What is Covered and How to Avail PayPilipinas

How to File for SSS Sickness Benefit SSS Guides

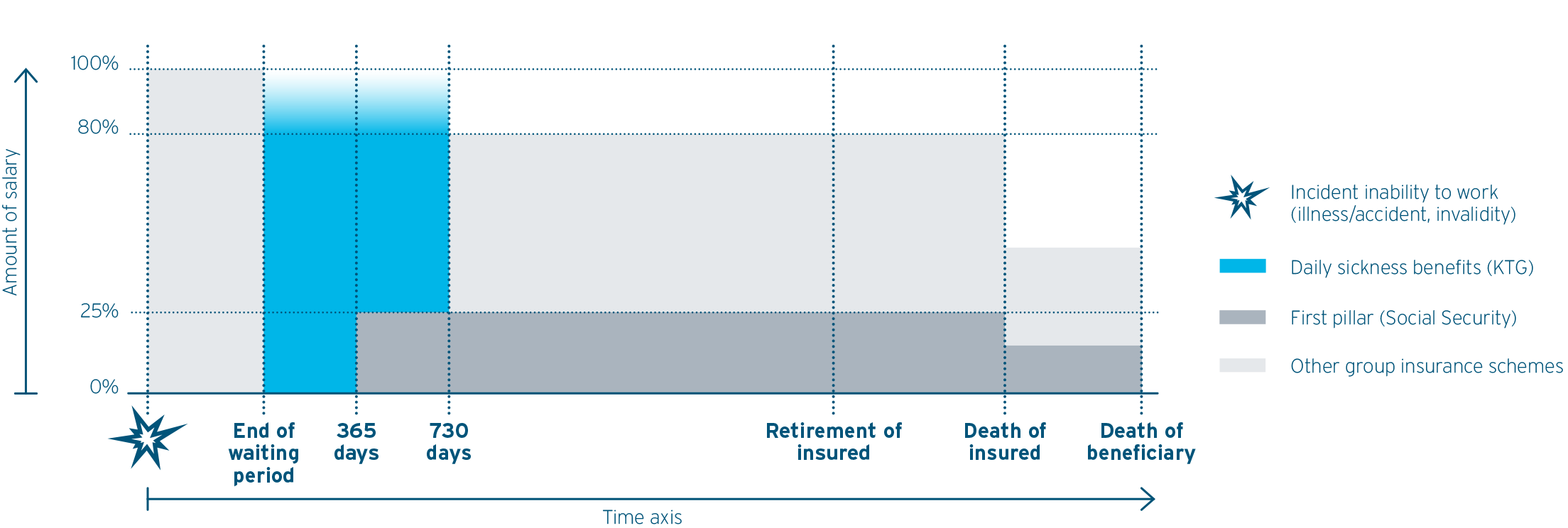

Daily Sickness Benefits elipsLife

HOW TO APPLY SSS SICKNESS BENEFITS WHILE WORKING OVERSEAS YouTube

How to Submit your Sickness Benefit Claim using your online MySocialSecurity account. YouTube

Filing for SSS Sickness Benefit Forms, Requirement, Processing Time (2023)

Paano mag file ng Sickness Benefit sa SSS Requirements for Sickness Benefit 2024 YouTube

How To Compute Your SSS Sickness Benefit HowButingtingWorks

If you take time off from work due to sickness Health insurance benefits UD Trucks Health

How To Process And Avail SSS Sickness Benefit

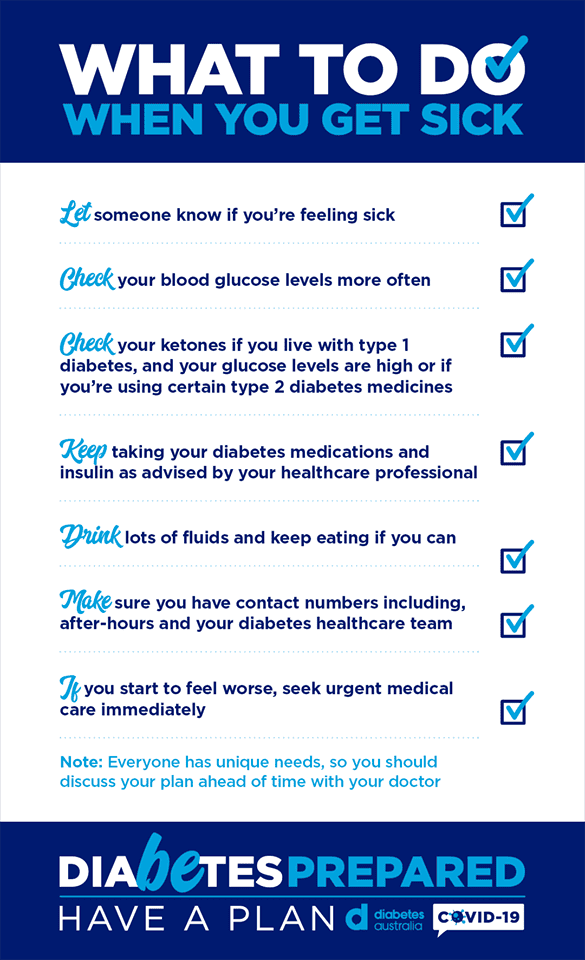

Be Prepared Sick Day Management Diabetes Australia

THOUGHTSKOTO

THOUGHTSKOTO

Sick and carer's leave are part of the same leave entitlement. It's also known as personal/carer's leave. The yearly entitlement is based on an employee's ordinary hours of work and is 10 days for full-time employees, and pro-rata for part-time employees. This can be calculated as 1/26 of an employee's ordinary hours of work in a year.. This is a Services Australia payment for people who experienced harm because of a COVID-19 vaccine. You can no longer claim the Pandemic Leave Disaster Payment and High-Risk Settings Pandemic Payment. If you received these payments you need to include them in your tax return. Find out more about what government payments and allowances to report.